Opportunity Snapshot

- Country:

Nigeria

Nigeria - Industry: Energy, Natural Resources, Mining

- Stage: Start-up

- Investment size: $100,000,000 / min. $100,000,000

- ROI: 100% in 3 years

- Type of investment: Debt, Equity

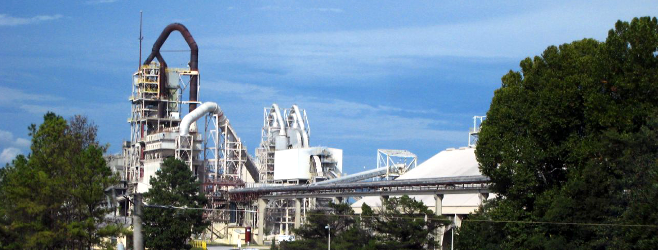

Market survey carried out in Nigeria shows that customer demand for cement is continually exceeding the quote of 30 million tons per annum to the cement market before the end of 2017. Image courtesy: Doug Waldron, 2007, Flickr CC.

Market survey carried out in Nigeria shows that customer demand for cement is continually exceeding the quote of 30 million tons per annum to the cement market before the end of 2017. Image courtesy: Doug Waldron, 2007, Flickr CC.

Investment Opportunity

Nigerian Company willing to conglomerate with a foreign investor to involve in the manufacturing of cement, lime and aggregate.

Investment Opportunity

We are looking for funds to set up a 5000 tons per day cement plant, 2000 tons per day hydrated lime plant and 2000 tons per day aggregate plant. The cement production costs is estimated to be US$60 per ton. The current market cement price in Nigeria is US$107 per ton and the hydrated lime market price is US200 per ton. Aggregates production is estimated to be $5 per ton, whereas the current market price is $10 per ton.

The limestone deposit/concession covers an area of 1200 acres, with an estimated reserves to well over 300 million tons. Feasibility studies will be carried out on the area of rock chippings by the investor to show the concession to have high grade limestone.

Market survey carried out in Nigeria shows that customer demand for cement is continually exceeding the quote of 30 million tons per annum to the cement market before the end of 2017.

The hydrated lime which is used in the production of copper cathodes and other copper products is in high demand in the West African region, with the ever increasing number of copper production from mines expanding and new ones being constructed. Aggregates are needed for the construction of tarred roads, making the demand for the material very high.

Competitive Advantage

• Our knowledge in the cement industry.

• Warehouses located along line of rail.

• Already selling cement for a large manufacturers.

• Already have established buyers in Nigeria and around West Africa.

Rationale for the deal

Currently there is a high demand in Nigeria and in the West African region and it is set to increase every year. We are also, currently have a large manufacturer and our license with the Federal/State Government is for 10 years and is renewable annually.

Use of financing

The investment required is US$500 million which will be used to setup all 3 plants on one site with a mining right license covering 1200 acres.

Opportunity for the investor

We offer 70% to the investor.

Looking for similar investment opportunities