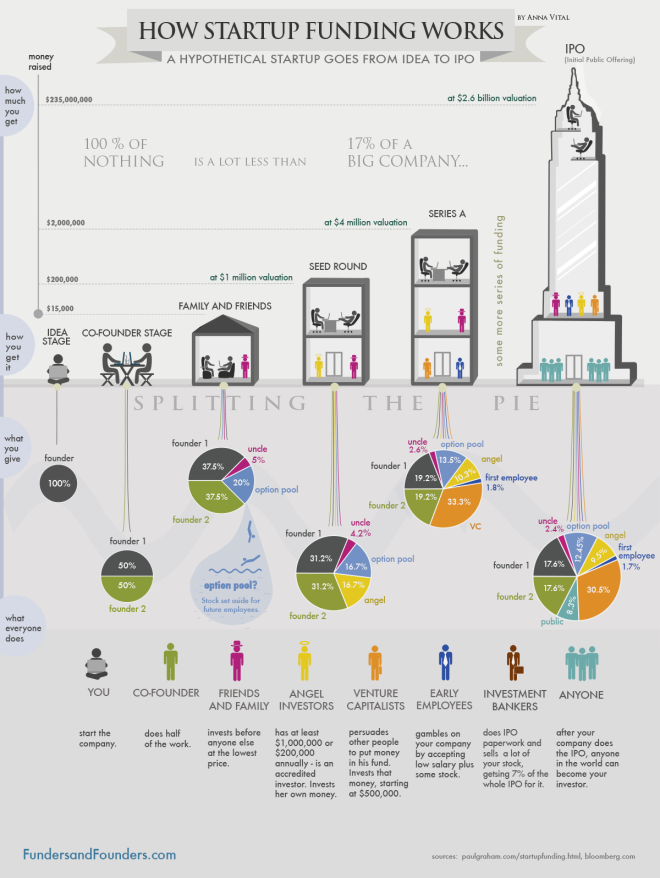

Naturally, entrepreneurs who have put their hearts, minds and souls into developing a business idea are reluctant to share their venture with others. However, equity investment might be the only way to materialize your business plans. Since owing 100% of nothing is a way less than having a smaller bit of a successfully running company, splitting up the pie - i.e. giving away a part of your company - is often the best thing to do.

Equity investment is extremely important at the early phases of the business, when the risk is high and the banks are reluctant to provide finance. Whilst personal resources and those of co-founders, family, and friends might help to develop the idea and register a company, the startup and “survival” stages usually bring the necessity of additional external capital. This so called venture capital can be provided by business angels and/or venture capitalists. In addition to the capital injection, angels and VCs can help you push your business through by giving you professional advice or even taking active part in your company’s management.

Where are such investors to be found? VC’s are usually formal organizations, so you can find their contact details in business directories and on the web. Angels are individuals or informal groups of individuals and are hence more difficult to identify and approach. You can ask your connections for referral, visit investment-related conferences and events, or turn to an investment broker. Both business angels and VC representatives can be found on Merar. What you need to do, is just to register as an entrepreneur and publish a description of your investment project. No matter which channel you use to reach investors, you should be well prepared. You can read more on how to effectively present your business in front of investors in our blog.

Funding through equity is of course not reserved for the initial stages of development. During growth or maturity you may wish to raise capital by inviting new partners, entering equity-based alliances with other companies, or going public. Advantages of equity finance versus debt finance generally refer to smaller risk, greater amounts of cash at hand, longer repayment periods, and lack of obligation to repay the investment if the business fails. What you lose however is the control over your company, since you have to consider the other owners’ opinions when making managerial decisions and to share with them the company’s profits.

You can get a neat overview of the equity investment stages and sources throughout the lifecycle of the company captured in the following inforgraphic taken from the same article:

Source: Vital, Anna (2013). How Funding Works – Splitting the Equity Pie with Investors. Funders and Founders, 9th May 20113. Available at: http://fundersandfounders.com/how-funding-works-splitting-equity/?goback=.gde_47993_member_239953289 Accessed: 14.05.2013.

Top image courtesy: reynermedia, 2013, Flickr CC.

Comments

blog comments powered by Disqus