Providing relevant information that will help our customers to better protect themselves from investment-related risks is one of Merar’s priority tasks. In our blog archive you can find plenty of articles on the scam threads entrepreneurs are facing when looking for funding. Since investors who seek opportunities are also objects of scam attacks and deserve equal attention and support, with the current article we wish to alert them on some traps they might be lured into.

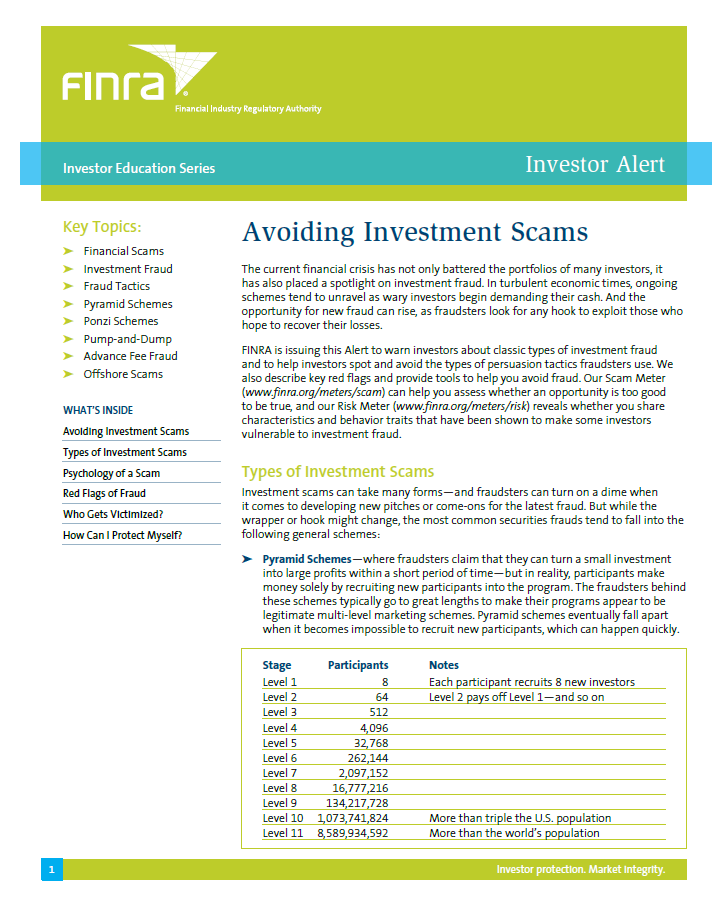

To get a professional opinion, we referred to a reputable institution that has investor protection as its primary goal – the Financial Industry Regulatory Authority of the United States (FINRA). With their permission, we are sharing with you a summary of the article “Avoiding Investment Scam” written by FINRA’s experts on the topic of scam in the field of securities investment. Although FINRA is operating solely in the US, we believe that their insights and tips will be valuable for the whole global investor community.

To recognize scam schemes, you should be well informed about how they function. Here are the most common securities fraud schemes reported in FINRA's report:

- Pyramid Schemes: Instead of reaping quick and impressive profits as promised, investors get the limited opportunity to have some payback only by attracting new investors to the program.

- Ponzi Schemes: The amounts collected by the investor are used to pay purported returns to earlier-stage

investors. - Pump-and-Dump: False information about an unpopular company is being spread to raise interest, and

hence, the stock price. After investors purchase shares at the higher price, the fraudster dumps his shares and disappears. - Advance Fee Fraud: To take the offer to purchase a low-priced stock, the investor is asked to pay in advance a service, which they never get back. The stock opportunity also proves to be false.

- Offshore Scams: May take different forms of fraud which will be impossible for domestic anti-fraud bodies to react upon

In the case of securities investment, fraudsters use a sophisticated approach and are sometimes difficult to recognize even by experienced investors. FINRA warns that they “are masters of persuasion, tailoring their pitches to match the psychological profiles of their targets”. However, the report points out some red flags that should draw awareness:

- Negligence of the risk factor (profits 100% guaranteed)

- Unregistered securities offered by unlicensed individuals

- Promises of overly steady returns

- Complex and unclear investing techniques

- Missing documentation (stock or mutual fund prospectus /bond

circular; stocks symbols) - Discrepancies in the investor’s account (unauthorized trades,

missing funds or other problems with the investor’s account statements) - A pushy salesperson requesting immediate decision

As FINRA's article advises, to best protect themselves investors should pay attention to those red flags, learn to identify and resist fraudsters’ persuasion tactics, ask detailed questions about the investment deal, the risks related and the individuals involved, and then validate the answers provided.

We’d recommend you to check out the tools develop by FINRA to help investors assess the scam risk associated with an opportunity - the Scam Meter and the Risk Meter.

Feel free to share your experience and recommendations about identifying and fighting scam – your story can protect other people from becoming a scam victim.

The Financial Industry Regulatory Authority (FINRA) is the largest independent regulator of the securities industry in the United States. Its scope of activities include creation and enforcement of federal securities laws and rules for securities companies, registration and education of brokers, examination of securities firms, as well as monitoring the trading in the US stock markets.

Image source: Andrea, 2008, Flickr CC.

Comments

blog comments powered by Disqus